Curve Finance – a new era of spot FX on blockchain

Founded as an innovative way to trade in stablecoins as an alternative to more volatile crypto assets, the scope has expanded but the stakeholder benefits are sometimes less clear. This blog explores Curve Finance, the business case for adoption and the role of regulation.

What is Curve Finance?

Curve Finance is a permissionless automated market maker (AMM) platform that allows digital assets to be traded using liquidity pools instead of traditional centralised orderbook matching.

Since its launch in 2020, Curve Finance has grown become a top-10 DeFi protocol with a “total value locked” (a measure of the total liquidity available on the platform) of around 5.78 billion USD https://www.defipulse.com/projects/curve-finance. Curve was originally designed to compete with Uniswap in the spot exchange of stablecoins but its scope has extended.

Figure 1 Figure 1

How Curve Finance differs

Foreign exchange markets are core institutions that ensure access to liquidity in local and foreign currencies. Historically, exchanges are heavily regulated centralised market infrastructures and barriers to entry for market participants are usually high.

As decentralised entities, AMMs—such as Curve Finance—challenge this approach by being totally open: anyone can participate using smart contracts regardless of jurisdiction. Furthermore, Curve is non-custodial with no prerequisite to deposit funds in a custodian account in order to trade.

Curve and other AMMs facilitate the exchange of tokens using liquidity pools. These are smart contracts that hold tokens provided by market makers and liquidity providers. Participants earn trading fees and rewards in return for locking their tokens in liquidity pools so all participants are incentivised.

The business case for stakeholders

Trading fees are typically 4 basis points (bps). Half of these fees are distributed to liquidity providers with the remainder going to veCRV holders (a token issued in exchange for locking the Curve Finance governance token, CRV, in a staking contract). Liquidity deposits and withdrawals are normally subject to a fee ranging from 0 to 2 bps if they create liquidity pool imbalances.

Liquidity providers

Liquidity providers assume various risks by locking their assets inside the liquidity pools. They are rewarded for these risks through trading fees and various rewards mechanisms described below.

Curve Rewards

- Trading fees: Liquidity providers earn a small portion of the trading fees.

- Interest income: Certain pools lend the funds provided by market makers to earn additional interest via protocols such as Compound and Aave.

- Pool incentives: Certain pools are allocated a portion of new CRV token as rewards to further increase the attractiveness of these pools to liquidity providers.

Traders

Liquidity pools and market inefficiencies create arbitrage opportunities that traders can profit from while helping to maintain a fair market price. Traders also benefit from using Curve Finance due to relatively low slippage.

Governance System

Curve Finance issues a token with a finite supply (CRV) For more information on the Token, please refer to the documentation to incentivise liquidity on the protocol and voting on governance decisions. There are currently three core use cases for the CRV token:

- Staking to earn lending and trading fees

- Boosting to increase CRV rewards and voting power

- Voting on governance proposals

The CRV token can be earned from providing liquidity on incentivised pools or it can be purchased on the secondary market.

Curve Finance in a regulated environment

Curve Finance and competing AMMs signal a new standard in market transparency – all trades and liquidity information are easily accessible and visible on the blockchain.

While Curve has demonstrated product-market-fit with native crypto VCs and its retail customers, adoption by regulated players will require the protocol to adapt their offerings and work with regulated entities.

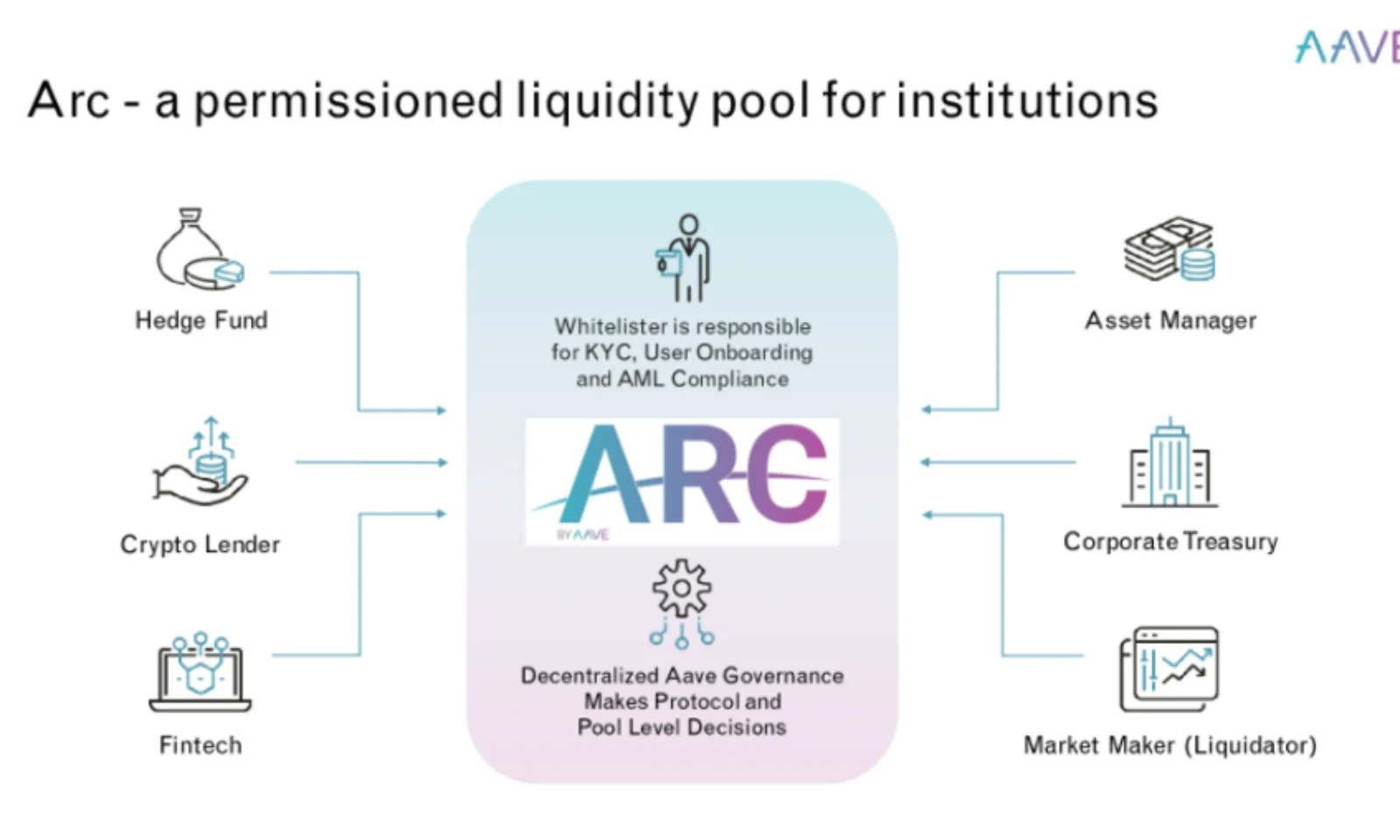

In January 2022, Aave, a lending and borrowing protocol, pioneered a regulated offering with Aave Arc, a permissioned liquidity pool based on a whitelisting mechanism. KYC and AML obligations as well as user onboarding are performed by a regulated entity Cointelegraph, Fireblocks.

Figure 2 Figure 2

A cycle of benefits for all

We believe regulated entities can—and should— play a critical role in the adoption of decentralised finance protocols. Decentralised finance will also create new opportunities for regulated entities to perform their roles as intermediaries and generate new revenue streams. Incumbents and innovators will benefit from driving further adoption of decentralised finance solutions by offering innovative products to their customers while ensuring proper safeguards are in place.

Disclaimer: The content below is for informational purpose only and should not be construed as financial or legal advice. Consult your financial advisor and lawyer prior to making any material investment decision. The views expressed in this blog post are those of the author only and do not represent the opinions of GFT or its management.